Everybody dream of becoming a millionaire but very few people can achieve this. Because you need to change your mindset and follow a disciplined approach.

If you don’t earn a high-end salary, you might be thinking that a net worth of $1 million is out of your capacity. But that’s not true. Your mindset, sound planning, and how religiously you execute can make all the difference.

#1. Evaluate your current finances

If you are set for growing your wealth to $1 million, then you must know where you are standing at present. Without knowing your current financial situation, you can’t create a sound strategy for your future.

Put your income and expenses on paper. You must know how much you earn, and where you spend your money. Be clear in that.

Then if you realize you should improve your spending habits, see what kinda expenses you can avoid so that you can save some extra money to invest.

The more you are clear about your spending habits, the less likely you do extravagant spending. The more appropriate actions you will take to achieve your financial goals.

#2. Eliminate debt

Debt is the biggest obstacle in your wealth creation journey. As per the CNBC report, an average American has a debt of $38,000 as personal debt and it doesn’t include home mortgages.

Can you think of creating wealth when a large sum of money is going in paying interest? The best way is to focus on eliminating your debt as soon as possible.

Most people pay credit card bills in a totally wrong way. They keep on paying minimum balance payments while the interest on the credit card debt keeps piling up.

Consider your credit card as an emergency way out rather than a luxury.

#3. Start investing as early as possible

The early you will start investing money, the more time you would get to take chances with your money. You can invest some portion of your savings into high-risk high return investments.

At an early age, you would be able to bear the losses if you occur at some point. As per CashOverflow, you can start investing in the stock market with as little as $100 initial investment.

Secondly, you would be able to utilize the power of compounding to grow your wealth exponentially.

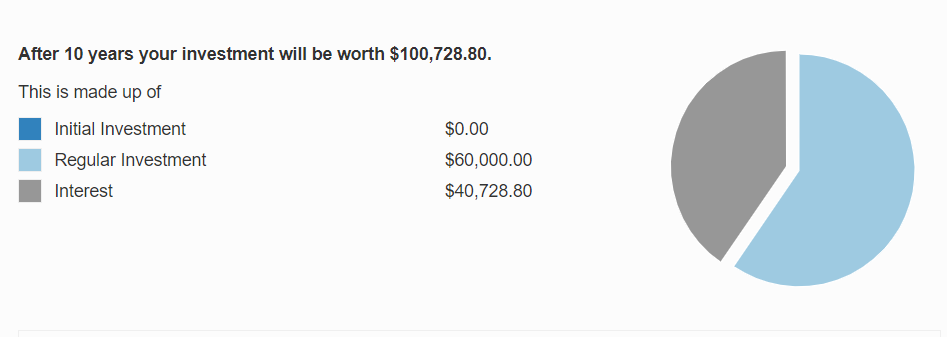

You can better understand this concept with the example below.

If you’re 30 and you set aside $500 a month, assuming a 10% annual interest rate, you would be able to accumulate $1 million in just 10 years.

See the chart below.

#4. Increase your current income

If you are thinking of becoming a millionaire by cutting your daily coffee, then you are wrong.

The best way is to increase your current income so that you have an extra buffer of money to invest somewhere.

Invested money works for you passively and creates a roadmap of your wealth creation.

You can start with your current employer. If there is a new position within your company that would suit you better while offering you a higher income.

You can learn new skills that would help you get better at your work. Investing in yourself is another important thing that you would monetize in the long run.

#5. Start new revenue streams

Remember one thing that a single income stream can’t make you rich. You must start a side hustle to generate extra income for you.

You can do some freelancing work as part-time to earn some extra bucks. You can provide consultation if you have some expertise.

It could be your professional skills that you have been using for multiple years or it could be your passion that you love guiding others like fitness, or relationship guidance.

You can also use your current hobbies into side business like photography, designing or writing.

The Bottom Line

You can’t become a millionaire by thinking or planning only. You need to change your mindset and take action.

You can use these tips that I have discussed to create a financial strategy that will reach you $1 million goal.

Be disciplined, and get out of your comfort zone to reach the milestone.