You may serve as a customer service liaison, a clerk, an analyst, a marketer, and even an accountant on an average day. With a butt-load of work that requires completion under very little time, it is often hard to bestow adequate energy to any of these tasks. Here we are referring to handling your books.

Accounting is the survival-game of businesses in multiple ways. It offers a living log for your connections and provides an outlook into your operations’ progress. As such, practical methodologies and accurate records are critically essential.

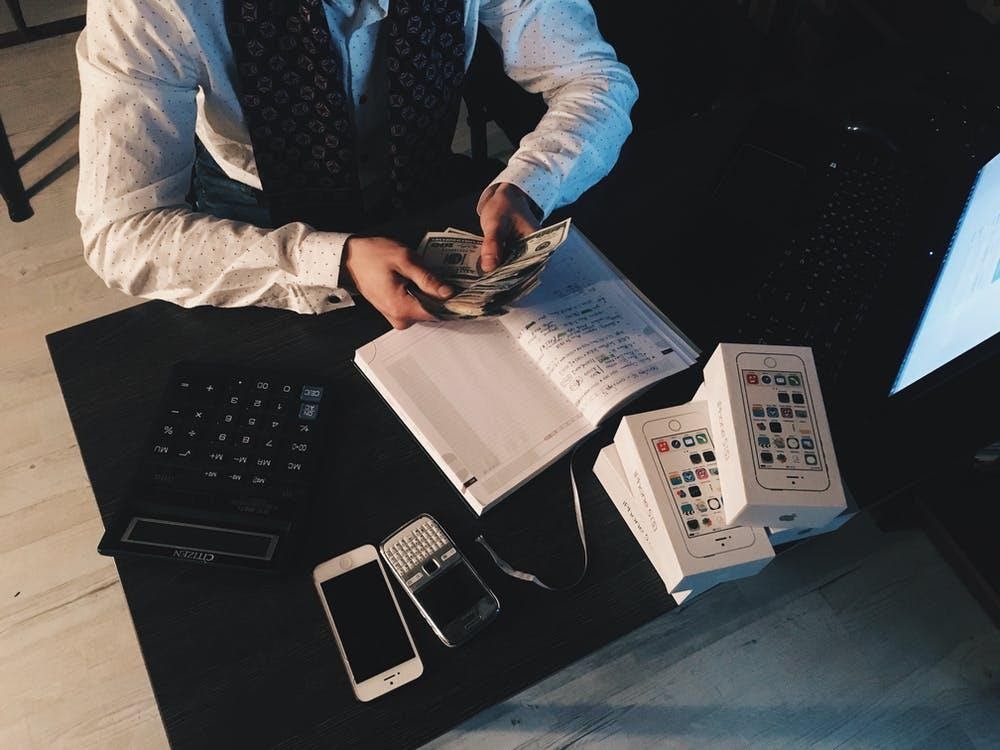

Accounting for small businesses is often the biggest bone breaker for thriving owners. Crunching the numbers can take a toll on you, but without sufficient tracking and preparation, not having a reliable cash flow can immediately cross your name from the list of “potential leaders.”

Also, to cope with the industry-madness, small businesses must do everything in their will to climb the ladder. So, where do you even begin? Incorporating authentic accounting strategies will leave you in a case of shock – as you will experience a change of pace.

We understand: sustaining and managing your finances can be devastating, and knowing exactly where to begin can lead to many sleepless nights. Thankfully, you are not hopeless. This article will discuss some viable accounting steps, particularly for small businesses that are having a case of management jitters.

- Create an Action Plan

When it comes to implementing any business-improving strategy, you always aim for a well-researched and thorough plan, right? So why should accounting be any different?

The key is never to restrain yourself. Put all the time and struggle into designing a rock-hard chart of accounts, financial reporting procedures and practices, and monthly close processes. A few misclassified transactions or missed entries can cost you hundreds of dollars, putting your business on the edge of a cliff.

If your accounting knowledge is a bit rusty, why not renew the lot? Reach out for an online master of accountancy program, and you’ll be all set to succeed in all the challenges coming forth. A small business specialist can also help you check off every product on the list and execute professional measures. On the whole, it allows you to move forward with self-assurance.

- Track Your Expenditures

The basis of impressive bookkeeping is accurate and efficient expense tracking. It allows you to monitor your improvement, keep track of deductible expenses, create financial statements, legitimize your fillings. It also helps with preparing tax returns.

From the very beginning, establish a system for managing receipts and other critical records. Additionally, five types of tokens require special attention:

- Out of town business travels

- Entertainment and meals

- Vehicle-related expenditures

- Home office receipts

- Receipts for presents

An upside to having a home-based business is that you get to keep a low overhead, plus you will qualify for specific tax breaks. You can deduct the part of your home used for business, such as your home internet, transportation, and cell phone. Any expenditure used partly for business use and partially for personal must reflect that mixed purpose.

- Choose the Perfect Software

You’d be a fool to manage your accounts manually. Therefore, the software you incorporate in your accounting practices means more than you think. While organizing expenditures in Excel and cutting checks may sound easy – a thriving business will soon spiral out of control without adequate organization.

A reliable accounting platform can offer a lot to your business, offering a firm foundation of consistency and quality. How about cloud-based software, like QuickBooks Online or an alternative to QuickBooks? These two are the best, providing access any time, anywhere, from any device.

Additionally, these kinds of startup solutions are generally quick to get the hang of, even for non-accounting professionals. However, accounting software isn’t the only savior you will need. A payroll platform is also vital. Tools like Wagepoint can make transactions quick and easy – and keep them in agreement with the federal and local tax laws – to keep the pressure of payday low.

- Make Outsourcing a Common Practice

Businesses require support; a lot of it. What used to be a few transactions a day soon become a hundred, leaving you with multiple entries to make in little time. That can be overwhelming, particularly for those without a stout background in corporate accounting organizations.

When your accounting responsibilities begin to supersede with your other tasks, you are not quite ready to hire a full-time wage earner to supervise bookkeeping. An outsourced plan B may be the perfect solution. Providing affordable and easy access to expert accountants without additional costs of an in-house worker; subcontracting can help you save a lot of vitality and time without destroying completeness or quality.

Outsourced bookkeeping and accounting services, such as Enkel, can assist you in tackling hectic tasks. It will be leaving you more free slots in your schedule to do what’s important.

- Calculate Gross Sideline

Enhancing your company’s gross margin is a critical step toward earning a groundbreaking income. To calculate the gross margin, you must know the expenses incurred to manufacture your product. Let’s dive deeper into this by defining both the gross margin and costs of the goods sold (COGS).

Gross margin: This figure represents the overall sales revenue left after the business incurs all direct expenses to manufacture the service or product.

COGS: These are the upright costs incurred in manufacturing products advertised by a company. It involves both direct labor and material costs.

- Re-evaluate your Methods time-after-time

Initially, you may find a spreadsheet to be the best option for managing your books. But you will want to consider more updated methods like Bench or Quickbooks as you progress. As you keep growing, frequently reassess the time you spend on your books and how much benefit it is giving to your business.

The best bookkeeping method means you can invest extra time in the business with bookkeeping no longer a part of your itinerary and potentially gain more money. Victory on both ends!

Conclusion:

Pay Attention to Your Numbers!

Indeed, nothing wears you out like starting a new business. From balancing every task to keeping the lights on, it can sometimes feel as though there’s no way out. However, a groundbreaking approach to accounting can make a massive difference, offering the tools you need to keep your business alive. Just put these six simple tips in your pocket, and you will find it easier to maintain your business’s pace.